Bond selloff begins

Let us not say we told you so, as we are not the only ones…. however given the confluence of events in the US of ultra low unemployment, moderate growth, and tax and fiscal stimulus led by the Trump administration we anticipate yield curves will steepen significantly this year.

Remember yield curves i.e. the shape of the curve indicates future expectations of interest rates, the longer the bond the higher it has to move in terms of yield to anticipate small changes in shorter-term rates. The Fed has indicated it wants to raise rates proactively i.e. ahead of increases in inflation, and we have a very aggressive US president in terms of tax and fiscal reform. The estimates as far as the impact of infrastructure projects like the Mexican wall are an increase in inflation of .2-.5% these I think are reasonably conservative especially given the impact of the recent changes in Corp. tax and the anticipated repatriation of billions of dollars to the US. This repatriation by US corporate’s will lead to higher domestic investment in research development and business expansion across the corporate sector which will translate much quicker into GDP growth than any other single factor.

Please see recent article from Michael Cartine senior rates analyst at Thomson Reuters which begins to give some bad news as expected on the government markets.

LONDON, Jan 10 (IFR) – Bonds have dropped lower and steeper overnight, extending Tuesday’s losses under a variety of pressures. Simple follow through after Tuesday’s down trade weighed in to start, as did further losses in JGBs, but the real killer – after Treasuries had managed a good bounce through London’s morning, were reports that Chinese officials have recommended reducing the country’s investment in Treasuries. 10-year futures promptly sold off just over 1/3 point on the news, and are currently down ¼ point from Tuesday’s settle.

Volume has been huge with 712k 10-year futures trading by 06:27 EST, while the March contract has marked a range of 123-03/122-23, last at 122-26. Customer flows feature talk of Japanese selling longer dated paper, other overseas accounts coming in as good buyers especially in the belly, and good selling from day trading types on the Chinese headlines.

Related markets show Bunds also lower, but only slightly, 10-year futures down less than a dozen ticks from Tuesday’s settle, despite taking down big supply. €5bn of a new 2/28 Bund has hit in a poor auction producing another technical failure (the third in a row for 10-year Bunds), and Portugal is bringing a new 10-year syndicated deal, Italy is bringing a new 20-year syndicated deal, and the EFSF is bringing a new 2/25 syndicated deal.

Bunds had actually bounced, alongside Treasuries, with deal-related receiving helping, before the Chinese headlines, coincidentally right before the Bund tap, hit. Regardless, 10s/Bunds trades 3.3bp wider, at +211.6bp last on Tradeweb. Within Europe spreads are slightly tighter to Bunds overall, by 1bp for 10-year Italy and France, although Spain is lagging and is little changed spread to Bunds.

Stocks show S&P futures down 11 points, while the Eurostoxx50 is down 0.4%, after the Nikkei dipped 0.3%. Gold has reversed an early dip lower and bounced to $1,325.26, reversing its losses for the last week and trading up to new highs for the year, and its best level since the middle of September, in the process. Oil has jumped $0.60 to $63.56, also a new high its best level since the middle of November. The yen has rallied 1 ¼ big figures to USD/JPY111.38, while the euro is up over ¾ big figure to EUR/USD1.2012, and the pound is modestly higher at GBP/USD1.3552

Nothing new there, the real dilemma is Europe. Yields are super-low in Europe, the ECB is still buying bonds, and unemployment is now dropping across the eurozone. Our assessment is that there will be a tipping point once US 10 yr rates reach 3% that will force the ECB to moderate (stop) bond buying, and raise base rates by between 50 and 100 basis points over the course of the next two years.

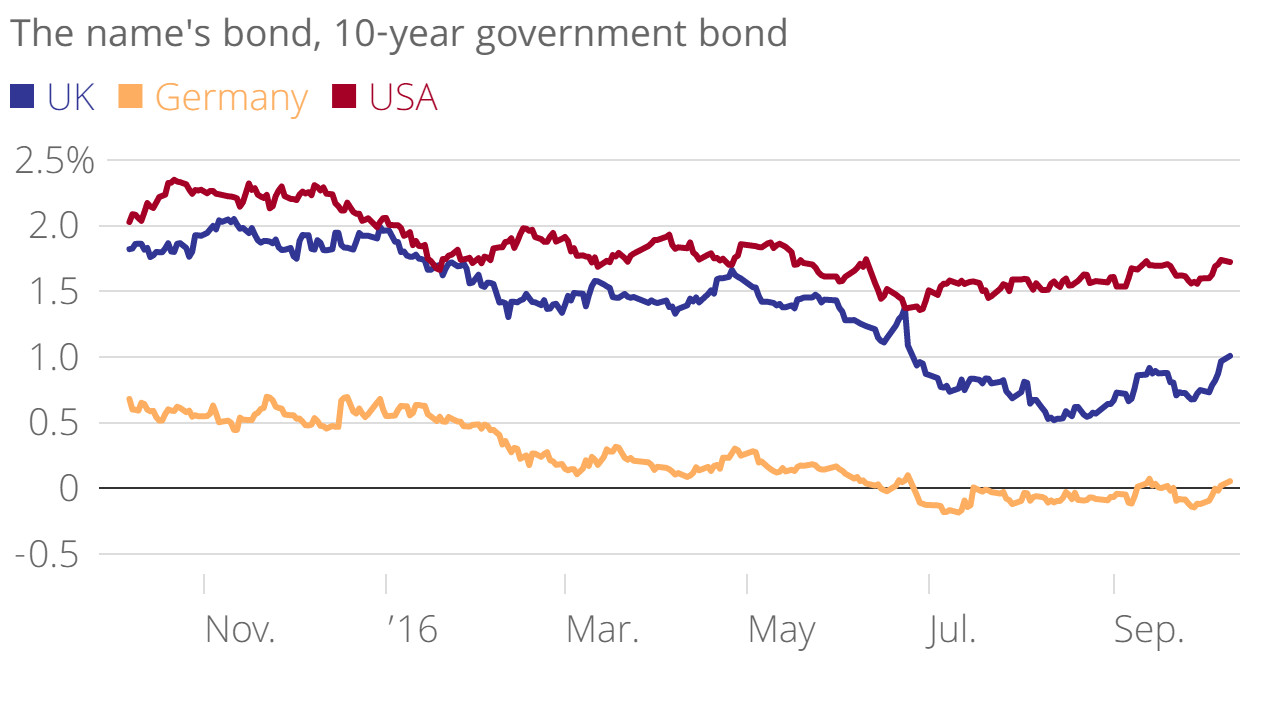

The graph below clearly illustrates the huge difference between Germany and the states, I also think it is very interesting to see that UK inflation as indicated by the 10 year government bonds is trending higher, this leads me to believe that investors are less concerned about negative influence on growth of Brexit, and conversely are more concerned by factors similar to those of the US i.e. full employment, increasing capacity utilization, strong corporate performance, and a weaker currency, all of which drive inflation higher and are stimulative to overall growth.

The ECB may wait slightly longer than it should in order to create a weaker euro i.e. higher US rates than European rates drive demand for that currency and force the dollar euro exchange rate to strengthen. The ECB once a weaker euro, they want the benefit to exports they want to benefit the current account to be felt as a result a weaker currency. Do not forget Germany is the by far the single biggest exporter in Europe and an economy which is export led and depends on its exports being competitively priced via the currency. Germany therefore has a vested interest in a weaker euro, and of course Germany has an overriding influence on the ECB and its policy regardless of what one would be led to believe about its independence.

Once the beneficial effect begins to feed through into European GDP growth and exports we expect the ECB to act very quickly and to raise rates much faster than the market expects. We believe bond purchases, negative interest rates, and supercheap repo financing will soon be things of the past.

Remember it has all been about currency wars… What do I mean by that I mean that the overriding concern of central banks and governments has been having a reasonably weaker currency in order to drive exports, improve current account balance, and generally speaking support the manufacturing sector as labor governments and most governments depend on that vote for reelection.

2018 I believe will be the year where investors want to be short long dated government bonds, perhaps you begin with the US, then rotate to the United Kingdom, but the real low cost option is …to be short German government bonds.

Why because the German yields are close to zero even in 10 years, and because Germany has reasonable growth low unemployment and is in better shape than the rest of Europe, the second main factors that the ECB at some point will no longer be able to distort supply and demand and will cease all bond purchases, in Germany for example they have already run out of eligible securities and had to migrate to corporate debt. We anticipate that the cessation of bond buybacks and of intervention by the ECB happens a lot sooner than the market is priced, therefore there is an arbitrage opportunity for nimble forward-looking investors.

Mr. Gargour is an investment manager based in London specializing in European fixed income. He is the chief investment officer of LNG Capital LLP a London-based fixed income hedge fund.

Please feel free to reach out to any questions or comments +442078393456 or LG@LNGcapital.com